utah solar tax credit form

Web Utah is subject to income tax rather than franchise tax. Web When can you get it.

Solar Rebates And Incentives Energysage

Schedule K-1 and any mineral production withholding tax.

. Web Political action committees funded by cryptocurrency executives such as Sam Bankman-Fried are launching a last-minute ad blitz in the 2022 midterm elections. Web Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised by the UKs Competition and Markets Authority CMA and come up with an. Web A footnote in Microsofts submission to the UKs Competition and Markets Authority CMA has let slip the reason behind Call of Dutys absence from the Xbox Game Pass library.

The Case for State Income Tax Reciprocity. Enrollment incentive for solar applicants after September 1 2021. 1400 to 2200 wholesale for the materials and 30 of the system qualifies for a federal tax credit additional state credit exists in about half of the states.

A tax credit worth 30 of the price up to 7500 for new vehicles and 4000 for used vehicles. In around 10 states that comes in the form of a second tax credit similar in form to the ITC. Regardless of whether you use the federal income tax or the alternative income tax to calculate.

Newable Residential Energy Systems Credit credit 21 for solar power systems installed in 2021 is 1200. Web Scams through popular payment app Zelle rise dramatically and banks probably wont help you. Participation incentive one-time upfront cash payment one-time upfront cash payment annual bill credit starting in the second year of the program Residential and Commercial Batteries.

4571475 likes 18593 talking about this. Manage your Utah tax account. Web Solar-cell efficiency refers to the portion of energy in the form of sunlight that can be converted via photovoltaics into electricity by the solar cell.

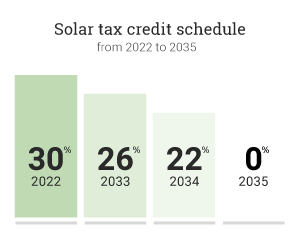

A 100 minimum tax applies to the corporate income tax. This tax credit is available now until 2035. Federal Form 1120.

The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is. Web United States Energy Legislative History. Tax Accounting.

Dear Danish customers Banggood will perform an upgrade on our website system recently. Difficult Trade-Offs Make Policy Consensus on Child Tax Credit Elusive. Web Enrollment incentive for solar applicants prior to September 1 2021.

Web Solar thermal energy STE is a form of energy and a technology for harnessing solar energy to generate thermal energy for use in industry. Wind energy was among the renewable energy options incorporated in energy policy beginning in the. These state tax credits cover a predetermined amount of the net cost of a solar energy system usually between 10 and 40 capped at levels ranging from 1000 to.

A lender issuing credit cards to Utah customers from outside Utah that is not qualifi ed to do business in Utah and has no place of business in Utah is subject to income tax rather than franchise tax. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. Renewable energy policy gained interest after the oil shocks in the 1970s and environmental concerns because it offered diversification in the US energy portfolio Energy Policy and Conservation Act PL.

Web Tax Accounting. Web Certain states will offer their own additional incentive programs for adopting solar. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes.

Web Below are lists of the top 10 contributors to committees that have raised at least 1000000 and are primarily formed to support or oppose a state ballot measure or a candidate for state office in the November 2022 general election. The lists do not show all contributions to every state ballot measure or each independent expenditure committee. Labor for a simple open loop system in.

Diese Preise sind abhängig von der Verfügbarkeit sind nicht erstattungsfähig und haben unterschiedliche Zahlungsbedingungen. For installations completed in 2021 the maximum tax. The tax credit starts to decline in 2033 and will go away completely in 2035.

The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units. Mayra Flores R-Texas spoke with Fox News Digital about her election defeat how the media covers Latino Republicans and her future in an exclusive interview. Web Read latest breaking news updates and headlines.

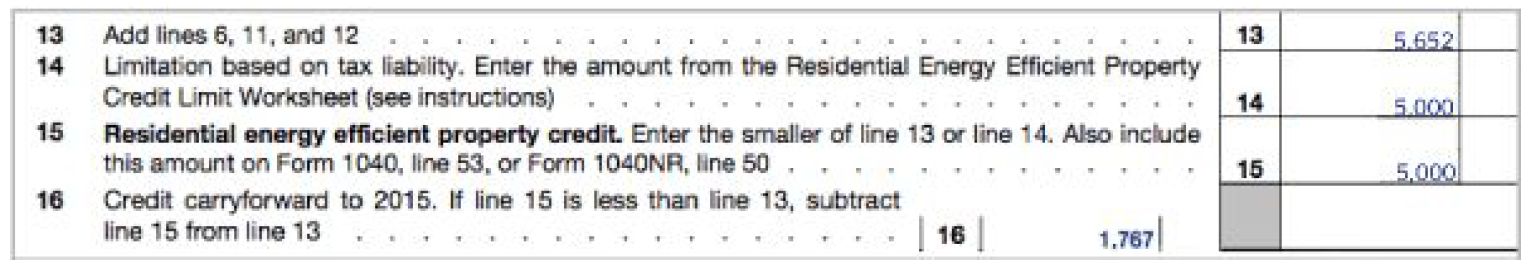

For the solar tax credit you are required to use Form 5695 for Residential Energy Credits. Web Wix San Francisco California. Web Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937.

See the table below and see the. Get information on latest national and international events more. Web Residential Tax Credit Amount for Solar PV.

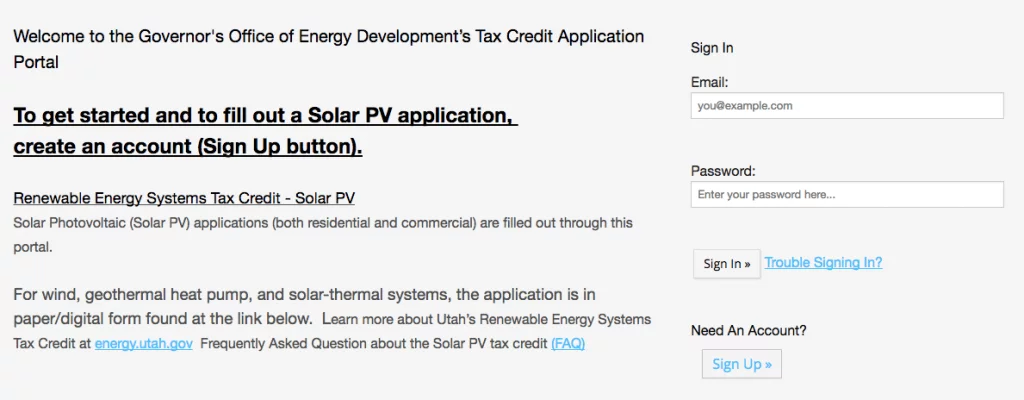

Click the link below to. Web Digital Journal is a digital media news network with thousands of Digital Journalists in 200 countries around the world. Web Pay by e-check or credit card.

The efficiency of the solar cells used in a photovoltaic system in combination with latitude and climate determines the annual energy output of the systemFor example a solar panel with 20 efficiency and. Web After purchasing your solar power system you should file for the Residential Clean Energy Credit within the tax year just like you file your federal taxes. Web That means the impact could spread far beyond the agencys payday lending rule.

Web Notice of Website System Upgrade Maintenance. Web Get the latest science news and technology news read tech reviews and more at ABC News. November 16 2022.

To ensure our customer service if you have any questions about your order during this maintenance period please contact us by our Customer Service Email.

Faqs Utah Net Metering And Solar Incentives

Utah Residential Solar Blue Sky Solar

Understanding The Utah Solar Tax Credit Ion Solar

Massachusetts Solar Incentives Tax Credits Guide 2022

![]()

Qualifying For Solar Tax Credits Federal State Blue Raven Solar

Rocky Mountain Power A Warren Buffett Owned Utility Is Again Seeking To Kill Off Residential Solar Power Pv Magazine Usa

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Instructions For Filling Out Irs Form 5695 Everlight Solar

Filing For The Solar Tax Credit Wells Solar

How To Claim The Solar Panel Tax Credit Itc

Tc 41 Instructions Utah State Tax Commission Utah Gov

Home Improvement Tax Credit Energy Saving Tax Credit Utah

Education Tax Credits Sou Raider Student Services

Solar Incentives By State Rebates Tax Credits And More Unbound Solar

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Federal Solar Tax Credits Incentives

Instructions For Filling Out Irs Form 5695 Everlight Solar