kansas inheritance tax rules

Kansas Probate and Estate Tax Laws. Each state has rules called the laws of intestacy that determine how to divide property when a spouse dies without a Will.

Tehelka Tv Promo News 01 Film Song Tv New Art

Kansas residents who inherit assets from kansas estates do not pay an inheritance tax on those inheritances.

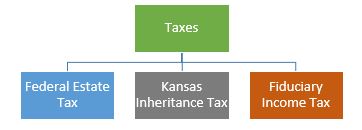

. Related Resources The probate process can be confusing. The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. Here are some details about.

Once the probate case is opened in Kansas the executor is responsible for a number of duties. Add a transfer on death deed to any real estate you own. The personal estate tax exemption.

Does kansas have inheritance tax. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver. In the tax year 202122 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that.

The Kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased. In this detailed guide of the inheritance laws in the sunflower state we break down intestate succession probate taxes what makes a will valid and more. There is no federal inheritance tax but there is a federal estate tax.

The advantages of an inheritance cash advance in Kansas include. Only a few states collect their own estate or inheritance tax. However if you are inheriting property from another state that state may have an estate tax that applies.

If the will stipulates an amount to pay the executor that amount is to be considered the total sum of payment the person receives. However it does address the issue of compensation. You may also need to file.

As a general rule only estates larger than 534 million have to pay federal estate taxes. The inheritance tax applies to money or assets after they are already passed on to a persons heirs. Kansas Inheritance Laws Probate Process.

The state sales tax rate is 65. Find out if Kansas collects either or both taxes on the. Assessment of the propertys value is done after a person dies to check if 534 million tax free limit is exceeded.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The state sales tax rate is 65. All Major Categories Covered.

Hire a good estate planning attorney. Kansas does not have an estate tax or inheritance tax but there are other. The Waiver is filed with the Register of Deeds in the county in which the property is located.

Kansas does not collect an estate tax or an inheritance tax. Kansas statutes dont provide a dollar amount or percentage of the estate that may be given as payment to the executor or administrator. Kansas Inheritance and Gift Tax.

You may also need to file some taxes on behalf of the deceased. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. Open bank accounts and designate heirs as beneficiaries of the accounts.

Kansas statutes dont provide a dollar amount or percentage of the estate that may be given as payment to the executor or administrator. Kansas has no inheritance tax either. In What Circumstances Does an Estate Have to Pay an Estate Tax.

Select Popular Legal Forms Packages of Any Category. You may also need to file. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

Beneficiaries are responsible for paying the inheritance tax on what they inherit. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. The minimum elective share is 50000.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Kansas does not collect an estate tax or an inheritance tax. However if you are inheriting property from another state that state may have an estate tax that applies.

In this detailed guide. Create a revocable living trust. Fortunately neither kansas nor missouri has an inheritance tax.

It consists of an accounting of everything you own or have certain interests in at the date of death. If you received property from someone who died after July 1. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

Make sure any real property is. In Kansas the elective share is based on the length of the marriage. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning.

Kansas has no inheritance tax either. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

The personal estate tax exemption. Not every state has them. Otherwise a spouse is entitled to 3 percent of the estate for every year of marriage from one to 10 years -- for example 6 percent for a two-year marriage or.

In 2019 that is 11400000. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. In 2021 federal estate tax generally applies to assets over 117 million.

The first 534 million is exempted from taxes. Read this article to find out who inherits if a spouse or parent dies without a Will in Kansas. Kansas law provides several protections for surviving spouses.

The estate tax is not to be confused with the inheritance tax which is a different tax. However if you are inheriting property from another state that state may have an estate tax that applies. Kansas does not collect an estate tax or an inheritance tax.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. If you die without a will in Kansas your assets will go to your closest relatives under state intestate succession laws. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of March 2013. Estate and allow tax hearings statements of public witnesses. For example Kansas estate.

If there is no will. Kansas does not collect an estate tax or an inheritance tax.

The Pittsburgh History Journal Eugene Smith Pittsburgh City Street Scenes

Grantor Trust Estate Planning Strategies To Implement Before The Biden Tax Proposals Take Effect Advicers Grantor Trust Estate Tax Estate Planning

Does Kansas Charge An Inheritance Tax

Kansas Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Will The Irs Extend The Tax Deadline In 2022 Marca

Kansas Inheritance Laws What You Should Know

Irs Announces Acquiescence In Per Taxpayer Mortgage Deduction Ruling Https Www Cspcpa Com 2016 12 13 Irs Announces Acquies Platte City Mortgage Overland Park

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Kansas Inheritance Laws What You Should Know

New Stimulus Package May Be Introduced Next Week Estate Tax Types Of Trusts Senate

Estate Tax Planning Graber Johnson Law Group Llc

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Estate Tax And Inheritance Tax In Kansas Estate Planning

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)